Introducing the Initial Public-Planet Offering (IPPO)

31 March 2025/ Resources / Article

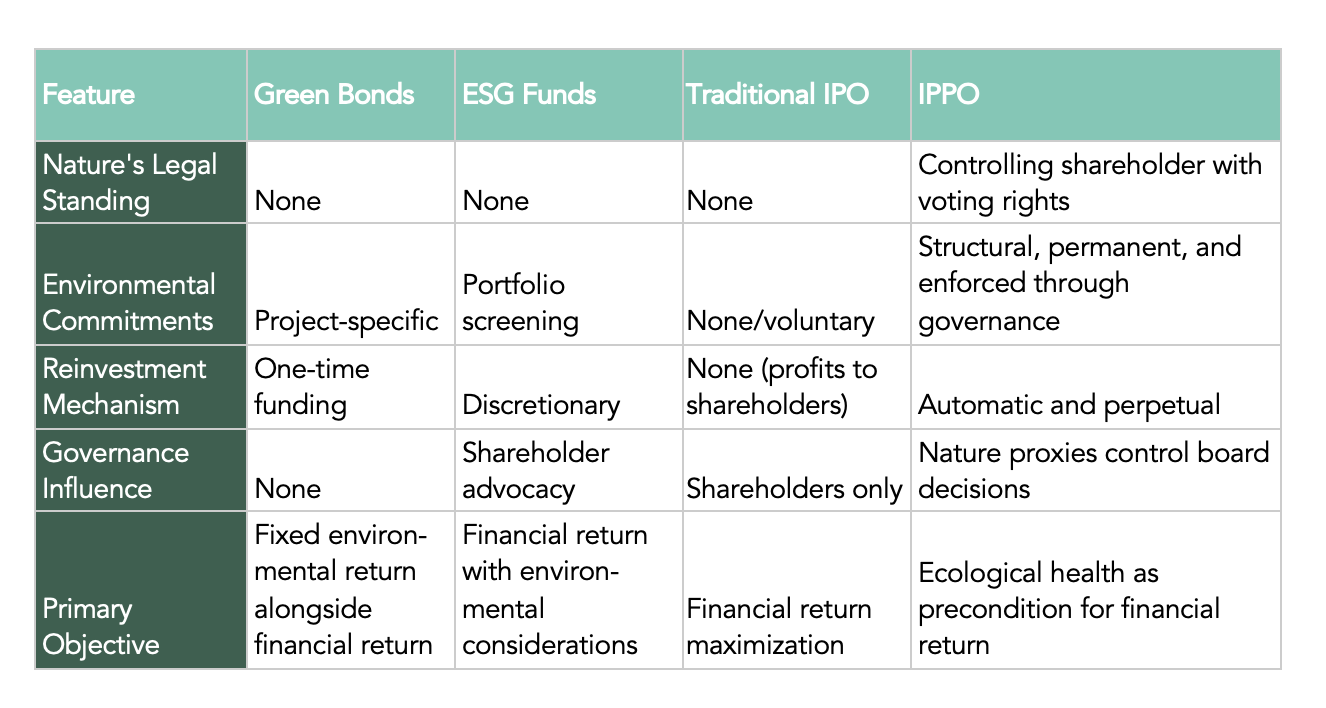

The global economy depends entirely on ecosystem services worth $180 trillion annually. Yet companies treat these services as free resources, bearing no fiduciary duty to the living systems that sustain them. The result? A $830 billion annual nature finance gap, accelerating biodiversity collapse, and a financial system that rewards extraction over regeneration. Green bonds, ESG investing, and impact funds have made progress. But they all share a fatal flaw: nature still has no real power when corporate decisions are made. What if we fundamentally restructured who controls companies?

The IPPO Model: Nature as Controlling Shareholder

The Initial Public-Planet Offering (IPPO) makes nature the controlling shareholder by permanently reserving at least 51% of voting rights for Nature Proxy Shareholders—Indigenous leaders, conservation scientists, community representatives, and ecological experts who hold fiduciary responsibility to ecosystems.

Nature Shareholders control board decisions, hold veto power over ecologically harmful activities, and direct 100% of their dividends into verified restoration projects. Multiple safeguards such as constitutional protections, binding ecological thresholds, and smart contracts ensure nature’s interests cannot be circumvented.

The governance model honors what Indigenous peoples call “two-eyed seeing”—integrating traditional ecological knowledge and Western science. Board composition includes both Indigenous knowledge holders with intergenerational wisdom and conservation scientists with quantitative expertise, creating governance that is richer and more legitimate than single-paradigm models.

How It Works: A Forestry Example

Imagine a sustainable forestry company launching an IPPO, raising $100 million: $51M in Nature Shares, $49M in Ordinary Shares.

Post-IPPO, the company earns $7M profit, declares $4M in dividends. Nature Shareholders’ portion ($2.04M) flows automatically to a Nature Restoration Fund for Indigenous-led stewardship, habitat corridors, and species recovery. Ordinary shareholders receive $1.96M in traditional dividends.

When shareholders propose expansion for revenue growth, Nature Shareholders conduct ecological assessment and approve with modifications: 20% of new area becomes protected corridor, traditional areas excluded, enhanced monitoring required.

Financial success generates dividends that fund restoration, which enhances ecosystem health, which reduces risks and creates new revenue, which generates more dividends for further restoration.

Why Now?

Five forces converge to create unprecedented opportunity:

- Legal precedent: Rights of Nature gaining traction (Ecuador, New Zealand, Colombia).

- Regulatory momentum: EU Taxonomy, TNFD requirements expanding globally.

- Investor demand: $35 trillion in ESG assets seeking authentic impact beyond greenwashing.

- Ecological urgency: $800B finance gap must close this decade.

- Technology: Blockchain, smart contracts, eDNA, and AI enable automated dividend reinvestment and real-time ecological verification.

Beyond Sustainable Finance to Regenerative Finance

While Natural Asset Companies propose monetizing ecosystem services, IPPOs address governance: nature doesn’t just need better valuation, it needs decision-making power. Can we create financial structures where nature’s health and investor returns are mutually reinforcing—not in theory, but by design? The full whitepaper—including detailed legal structures, governance mechanisms, risk analysis, and implementation roadmap—will be available soon.