Our nature investment database simplifies nature-based solutions deal sourcing and screening for institutional investors navigating the physical and reputational risks of the climate transition.

Access ~200 deal data points in one click, saving 8 hours of research and due diligence per deal.

Deal screening aligned with the U.N. and International Union for the Conservation of Nature (IUCN).

Contribute and compare risk and performance modelling forecasts with other investors to build market knowledge.

Asset maturation follows biological cycles regardless of the economy, and generates revenues through multiple income streams.

Regenerative Agriculture & Agroforestry

Sustainable land management, permaculture and agroforestry can enhance soil health, sequester carbon, and promote sustainable agriculture while offering financial returns.

Reforestation & Afforestation

Investing in reforestation or afforestation projects can generate market-rate returns through commodities and multiple other income streams, while enhancing biodiversity and sequestering carbon.

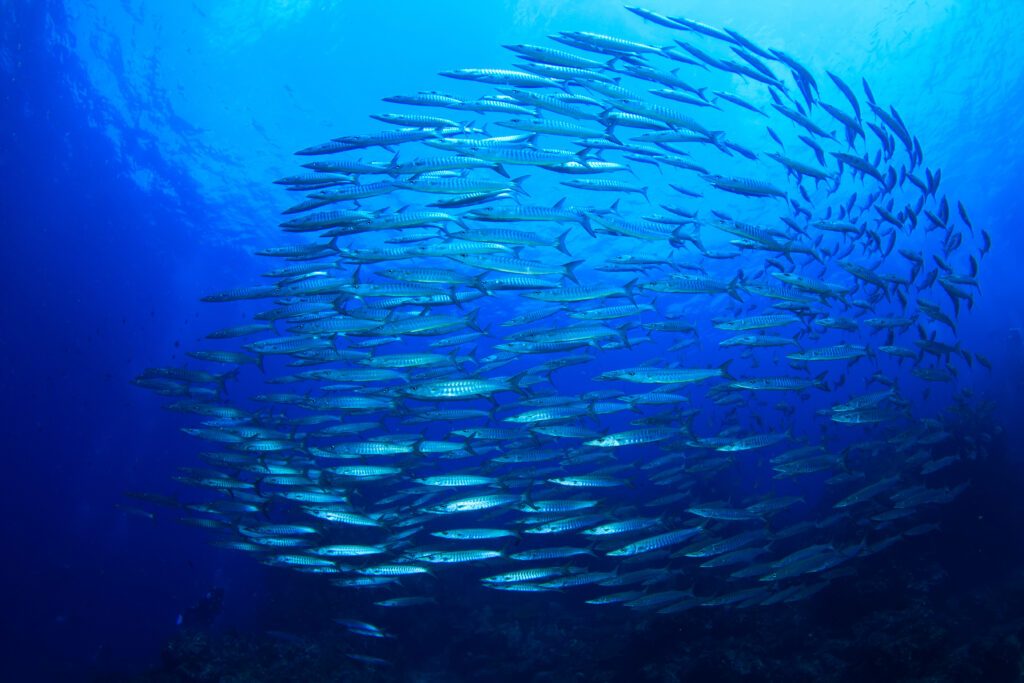

Blue Economy

Investments in sustainable fisheries and aquaculture can ensure long-term profitability while conserving marine ecosystems.

Green & Blue Infrastructure

Conservation and rehabilitation of wetlands, mangroves, and coral reefs enhance coastal resilience, reduce financial damages from flooding, erosion, and storm surge risks. While, urban forests can regulate temperatures and manage stormwater, increasing productivity and reducing damages.

Water Management

Investments in sustainable water management projects, including watershed protection and wetlands restoration, improve water quality, reduce runoff, and enhance groundwater recharge.

Commodities: Sustainable aquaculture products, timber, non-timber forest products such as cacao, rubber, fruits, nuts, medicinal plants for pharma, and carbon credits.

Payments for Ecosystem Services: A system of assigning financial value and compensation to nature’s contributions, thereby financing the preservation or enhancement of specific ecosystem services, such as clean water or carbon sequestration.

Nature’s growth is non-linear, compounding interest over time

© Symbaiosys 2025, All rights reserved.

GET ACCESS

Sign up to the complimentary Deals Newsletter here.